The European Union feels growing strain to lock in its supply of key minerals. China has tightened export rules on rare earths and linked items. These materials power batteries, magnets, wind turbines, and defense gear. A fresh study from the European Initiative for Energy Security (EIES) stresses the need. It urges special funds and smart money plans to build strong supply lines. And this change points to bigger moves in world mineral handling. Top-notch equipment plays a big part in boosting speed and freedom. As Europe boosts spending, chances open for expert fixes in filtration, mixing, and acid care. These draw on tried methods from known suppliers.

EU’s Push for Critical Minerals Security

Europe’s weak spots stand out clearly amid world tensions and supply breaks. China controls over 90% of rare earth handling. New export permit rules have slowed shipments. They have also hiked costs for EU makers. And this worsens dangers linked to green energy shifts and arms build-up.

Responding to China’s Export Restrictions

China’s April steps added seven rare earth items to its control list. All shipments now need government nods, no matter the destination. This adds to earlier limits. It hits materials key for electric cars and green setups. The EIES study warns that Europe might fall behind U.S. efforts without fast moves. U.S. plans include cash stakes in home rare earth firms like MP Materials. EU steps list 13 outside supply projects and plan backup stocks. Yet critics say these lack strong cash support.

EIES Recommendations for Investment and Coordination

To close the gap, the EIES suggests setting aside money from energy and green budgets for key minerals. It also wants the European Minerals Investment Network (E-MIN). This setup would connect backers, buyers, and builders for shared risks and quicker projects. Bodies like the European Investment Bank should copy U.S. ways by taking bigger ownership shares. This builds clear rules to beat red tape. As EIES boss Albéric Mongrenier said, such moves would turn plans into real wins for self-rule. These ideas go past digging to cleaning and handling stages. Bottlenecks there often block growth. By focusing on joint cash plans, Europe seeks to spread sources and strengthen home skills.

Signals for the Global Minerals Sector

The EU’s stronger focus shows a world turn toward self-made supply chains. It shapes cash flows and tech use. As countries fight to cut ties, handling steps gain notice for adding worth.

Heightened Demand for Processing Infrastructure

Key minerals like nickel, cobalt, and rare earths need complex wet methods and split processes. They pull out pure results. China’s hold on mid-step cleaning raises the call for other paths. EU plans stress friend countries for start and end growth. This push raises need for setups tough against harsh settings, like those with sulfuric acid soaking common in nickel and alumina pulls. Studies show good projects fail from cash holes. And this hints at openings for equipment that lifts output and green ways.

Opportunities in Diversified Supply Chains

Spread efforts, including G7 talks on base prices and team replies, spotlight the drive for non-Chinese handling spots. In areas like Australia and Indonesia—full of laterite nickel—better equipment can speed gains. This shows in wet nickel projects where new steps turn trash into extras like manganese carbonate for batteries. For Europe, this means cash in flexible, fast systems to grow ops quick. It cuts risks from low sulfur gas or dirty ores common in new sources. Such trends stress equipment’s key role, from solid-liquid split to used heat grab. They allow cheap and earth-friendly handling.

Essential Equipment in Mineral Processing

Trusty equipment supports the smooth run of mineral chains, especially in wet paths that lead key mineral pulls. New ideas here tackle rust, growth, and energy save issues in soaking and cleaning.

Filtration and Separation Innovations

Filtration equipment shines in managing slurries from acid soaking. It splits solids like phosphogypsum or aluminum hydroxide to give thick liquids. Big rotary filters and upright press filters, for example, reach full split in phosphoric acid or alumina streams. They raise flow while cutting waste. These setups often get tailored through lab and test runs. And this ensures fit to different ore types, vital for handling varied key minerals amid supply changes.

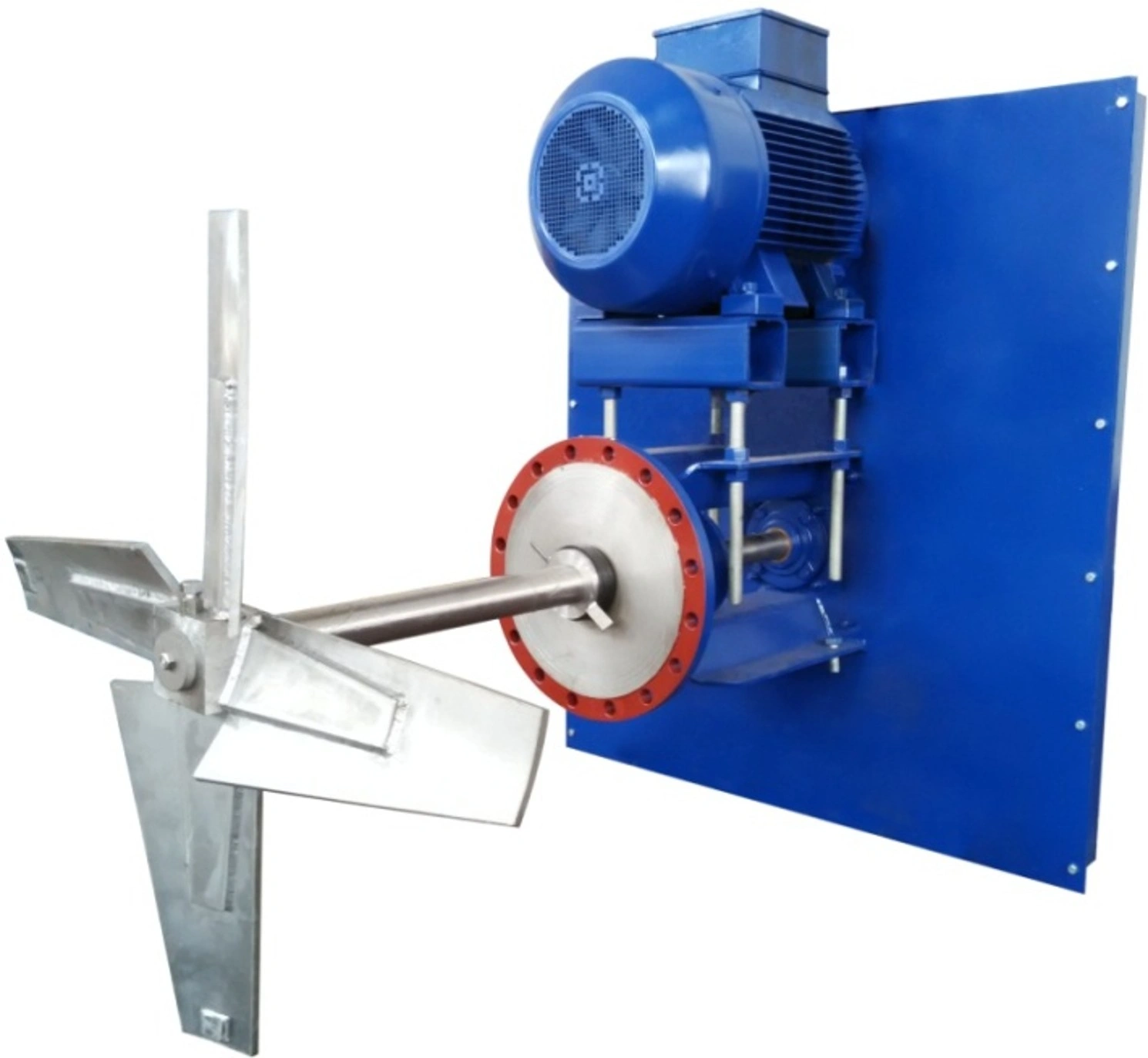

Agitation, Thickening, and Acid Handling Solutions

Mixers and thickeners improve reaction tanks and settling steps. They keep even blend in harsh liquids to lift pull rates. In sulfuric acid-heavy work, special spreaders and mist catchers stop fog carry. They better gas-liquid touch in soak towers. Low-heat waste recovery built in these aids green goals. It makes steam for power or warmth—key as EU rules push carbon cuts. Proven builds, like two-way stainless steel covers, cut costs and stops compared to old rubber-brick ways. This equipment group not only raises work trust but also fits round economy aims. It pulls worth from leftovers.

Jiangsu New Hongda Group: A Trusted Supplier

Jiangsu New Hongda Group Co., Ltd. (NHD), started in 1992, serves as a solid source of Filter Series, Automatic Press Filter Series, Agitator & Thickener Series, Equipment for Sulfuric Acid Industry, Pressure Vessel Series, Desulfurization Equipment Series, Filter Cloth Series, and Material Series. With reach in 52 lands and skill in phosphate chemicals, alumina, laterite nickel hydrometallurgy, and sulfuric acid plants, NHD gives custom fixes backed by over 800 patents and local R&D spots. Works like huge filters for Shandong Xinfa’s alumina lines (up to 240㎡, world’s biggest) and fresh reaction tanks for Indonesian nickel jobs show its strength in allowing big-scale, money-making handling—perfect for new key mineral starts.

Conclusion

The EU’s work to strengthen key mineral supply lines amid China’s limits offers a big shift for the field. It puts cash focus on handling tech that ensures speed and strength. Suppliers like NHD, with field-proven equipment for filtration, mixing, and acid care, stand ready to back this growth. They build lasting rise from mine to market.

FAQs

Q1: What role does filtration equipment play in critical mineral extraction?

A: Filtration is key for solid-liquid split in soaking steps. It allows pure metal recovery like nickel and rare earths. It handles harsh slurries well. And this lifts yields and cuts harm to nature.

Q2: How can agitation and thickening equipment enhance sulfuric acid-based processing?

A: These systems keep full mix and settle in reaction pots. They make best acid use and limit energy loss. This appears in wet nickel works where they raise gains through new steps.

Q3: Why invest in desulfurization and waste heat recovery for mineral plants?

A: They push cleaner runs by grabbing smoke and reusing heat. They match EU green goals and make extra worth, like steam for power. And this makes projects stronger for cash over time.